Hindenburg’s recent report claims, among other things, that the payment company Block has exaggerated information about its users, among whom there would be a large number of fake accounts.

American activist short and research company Hindenburg has taken the payment company Block, whose share price slipped on Thursday, as its new target.

Block develops payment-related services such as Square and Cash App. The company was formerly known as Square.

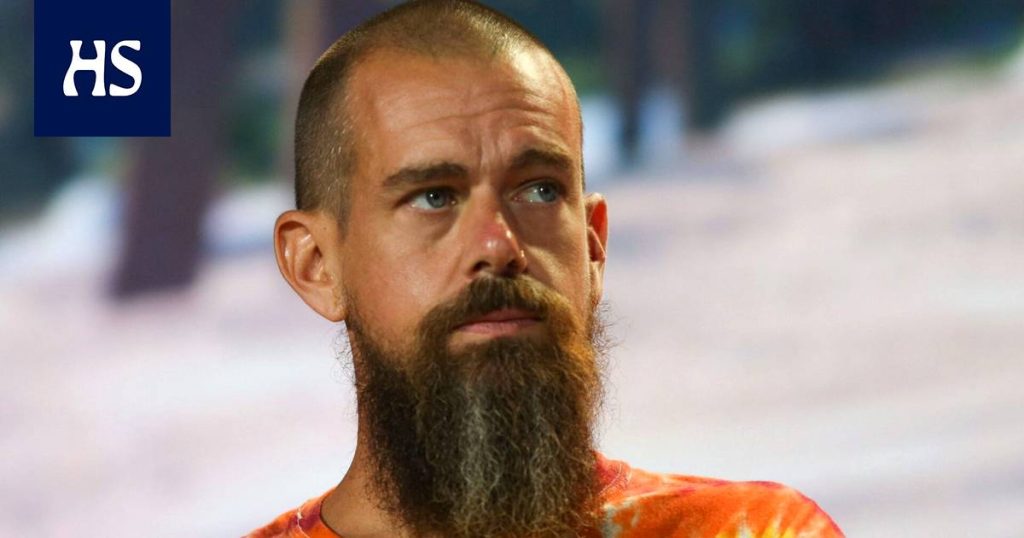

Hindenburg claims in his report that he was founding Twitter Jack Dorsey’s The Block company he leads has, among other things, exaggerated its user numbers and underestimated the costs of its customer acquisition.

Earlier this year, Hindenburg made headlines after publishing his report on the Indian conglomerate Adani. The report caused more than 100 billion dollars to melt from the value of Adani companies’ shares.

Read more: The report led to a hundred billion dollar stock slide and the burning of effigies of the Prime Minister – What is it about?

Fresh in his report Hindenburg claims that former Block employees estimate that 40 to 75 percent of the company’s user accounts are fake accounts or parallel accounts of the same user. According to the report, some of the fake accounts seem to have been set up to trick users.

In addition, Hindenburg mentions that the company’s founders Dorsey and James McKelvey sold a total of more than a billion dollars worth of shares during the corona pandemic, when Block’s stock rose sharply.

According to Block, Hindenburg’s report is “inaccurate and misleading” and “intended to deceive and confuse investors”, according to Reuters. The company is considering legal action and plans to contact the United States Securities and Exchange Commission (SEC) for that purpose.

Cash App -application allows users to transfer money to each other, and it is also marketed as a tool for investing and buying cryptocurrencies. According to Block, the app had 51 million monthly users in December, 16 percent more than a year earlier.

Blockin the stock was in a heavy slide right at the beginning of the trading day, but the decline eased as the day progressed. After 20:00 Finnish time, the share was down 15 percent at $61.5.